The gospel according to Adam Smith

Is doing good compatible with making money?

It is if you practise spiritual capitalism. - by Carleen Hawn

Art DeLorenzo and I were having a hard time connecting. He’s a 67-year-old retired financial adviser in the New York City area whose budding consulting practice keeps him from settling into an easy chair. I’m a journalist in San Francisco, perpetually on deadline. Several appointments we set were moved or missed, but we kept trying. Late one evening, as we seemed finally to settle on yet another date for our interview, DeLorenzo threw out a comment that would prove as valuable as anything he said in our hour-long phone call days later.

“Wait a moment.” DeLorenzo paused. “I could say 3 p.m., but the group I’ll be meeting with before you, they tend to run over. It’s just their habit, but I know this. So I’d rather not book you right up against them. I don’t want to compromise the integrity of my commitment to them.”

The details of one man’s business schedule might not seem meaningful at first. But in that moment I realized DeLorenzo’s deliberate emphasis on a few choice words—“the integrity of my commitment”—was a straightforward yet eloquent statement of a still-fuzzy but increasingly important trend: spiritual capitalism.

Spiritual capitalism doesn’t mean prayer sessions on the shop floor and guided meditations in the boardroom. At least it doesn’t have to. What it does mean is the success of an enterprise is measured by values like “integrity” and “commitment” as much as by targets like “efficiency” and “profitability.” It’s based on the recognition that every businessperson—whether you’re the CEO of a major multinational or the head of your own small firm—is in the service industry, and the services rendered must benefit not just yourself and your shareholders, but the planet and other people as well. The first commandment of the growing spiritual-capitalism movement is: Taking care of business means taking care of others.

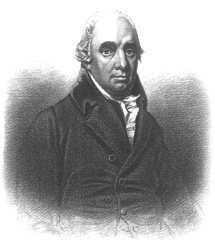

The spiritual father of spiritual capitalism is not Mahatma Gandhi or the Dalai Lama. It’s Adam Smith. After all, there’s a reason why his most famous work is called The Wealth of Nations and not The Wealth of Individuals. Smith, the 18th-century philosopher, argued that the free market—in which “every man, so long as he does not violate the laws of justice, is left perfectly free to pursue his own interest his own way, and to bring both his industry and capital into competition with any other man”—is the best way to build wealth. He also argued that the benefits of the free market should accrue not just to individuals but to society as a whole.

In his book, Business and the Buddha: Doing Well by Doing Good, management consultant Lloyd Field writes that “Smith presented this moral philosophy: ‘The average man and woman, along with the society in which they lived, should be the primary beneficiaries of a wealthy nation.’”

For anyone looking to incorporate spirituality in business, the bottom line is more than just the basis for commercial success; it’s the foundation for a just and sustainable society.

More and more companies, large and small, are taking a page from Smith’s book, even if many of them don’t use the word “spiritual” to describe what they’re doing. Google has coined the catchy corporate slogan “Don’t be evil,” and through its philanthropic foundation google.org has

committed more than $75 million in grants to research projects and investments that advance renewable energy and help entrepreneurs in the developing world. Staff at Allianz, the 118-year-old German insurance agency, learn to listen—with their hearts—to clients’ financial concerns to serve them better. Advisers at Ameriprise Financial, a retirement planning firm with $500 billion in assets under management, receive training in compassion, forgiveness and gratitude to help them become more successful. Dr. Hauschka Skin Care, a German distributor of holistic remedies and cosmetics, takes fair trade principles a step further by investing in the African communities that sell its products. One World Everybody Eats, a small café in Salt Lake City, Utah, in the U.S. asks patrons to pay what they can afford.

Why do companies like these do it? Not just because it’s the “right” thing to do, but because—yea, verily, even when walking in the valley of the shadow of recession—spiritual capitalism is a smart business move. Employees and managers who embrace spiritual values like compassion and forgiveness are happier—and therefore more productive. Add some soul to your sales pitch and guess what? You sell more.

Increasingly, consumers are using their purchasing power to buy stuff from companies that espouse spiritual capitalism. Witness the popularity of green energy, fair trade products and organic produce, as well as the growth of the socially responsible investment sector, a $2 trillion business according to the Social Investment Forum. Just as important is the fact that the perceived conflict between “doing good” and “making money” is on its way out.

“Most of us are in the habit of thinking in a linear fashion: If this, then not that,” says Terry Mollner, who co-founded the socially responsible investment firm Calvert Group in 1982. “If I care about profits, then I can’t care about being green. But we’re in a new era of collective consciousness now in which priorities don’t need to be hierarchical. The whole hierarchy is in the service of the common good, including the profit-making.”

Spiritual capitalism is consequently not a zero-sum game, but a holistic approach to business that’s quickly becoming more—much more—than the sum of its parts.

Spiritual capitalism got its start during the 1970s, in the business ethos that prioritized people over profits and gave birth to idea of social entrepreneurship. “We were hippies shouting to the masses,” recalls Mollner. “This was after the ’60s when we had a temper tantrum and thought we were rebelling against businesses that had only to do with profits. Everyone moved to the farms and started growing their own food. We set up community land trusts; we established alternative currencies. And out of all this came the idea for socially responsible businesses that would focus not on making a profit but on having a decent relationship with the employees, the environment and the community.”

These enterprises weren’t as successful as their creators had hoped. Why not? A big part of the reason was that without profits, they couldn’t be self-sustaining. Businesses can’t survive on good intentions alone. By setting up the Calvert Group, Mollner wanted to demonstrate that a company’s spiritual ethos could help it do good while giving it a competitive advantage. Some 30 Calvert-branded funds are on the market, representing hundreds of billions of dollars in market value, and socially responsible investing (SRI) has become one of the primary sectors in which money and spirit meet.

SRI began as a method for excluding socially harmful products—alcohol, tobacco, weapons—from investment portfolios. “We were evaluating companies based on what bad things they had done in the past,” Mollner explains. This quickly proved insufficient for SRI pioneers, so they began screening firms for the good things they were doing: for their spiritual values. “We realized that we wanted companies that were not just not doing bad things but that were promoting the common good,” says Mollner.

Today, SRI fund managers screen potential investments for environmental responsibility, social justice and corporate governance—all factors that contribute to a positive balance in the spiritual ledger.

Adam Smith would be proud.

The Munich-based insurance, banking and money management firm Allianz sells more than $160 billion worth of financial products and insurance policies each year. The company has operations in more than 70 countries, including the Netherlands, where Allianz salespeople receive training to help them identify and resolve their clients’ emotional and psychological issues about money. The goal, according to Paul Versteeg, director of asset management for Allianz Netherlands Group, is to enable salespeople to “hear their customers’ hearts” and give them better service. “You cannot listen to the heart of another person if you’re not able to listen to your own heart,” he says.

Versteeg, 48, took up his current post in 2004, after more than 20 years with Allianz. As soon as he began, Versteeg recognized he faced a serious challenge—Allianz’s brokers were perceived negatively by Dutch customers, who regarded them as slick, self-interested salesmen rather than genuine, helpful advisers. “What is our social responsibility as an insurance company?” Versteeg recalls asking himself. “We block out risks. We protect people. So why was our image so negative?”

One source of distrust turned out to be uncertainty about how salespeople earned their commissions. It also appeared that brokers were spending far too little time—just 84 seconds—listening to potential clients express financial concerns before launching into a sales pitch. “We were only selling a product instead of giving advice,” Versteeg says. “That needed to change. We had to put the customer in a central position and teach him to focus on the money barriers he may feel.” So Versteeg hired consultants George Kinder and Brett Davidson to teach Allianz staff the fine art of listening with their hearts.

Kinder, author of The Seven Stages of Money Maturity: Understanding the Spirit and Value of Money in Your Life, argues that many financial problems have more to do with our beliefs and attitudes about money than with our bank accounts. Before people can take the practical steps necessary to master their financial situations, Kinder believes they have to look at themselves and their hidden relationships with money. He developed the idea of “money maturity” as a framework to resolve what he calls “the apparent conflict between life and money.”

So while Davidson helped the sales force communicate with clients, Kinder helped them recognize and address clients’ emotional as well as financial needs. “A broker learns to find the emotional and psychological barriers a client has concerning money,” Versteeg explains. “What are his experiences of and memories about money? What has he done with money in his life? A broker has to find out these things by listening and asking the right questions. By doing that, he has to try to get through these barriers.”

Sounds great, but is it worth it? Versteeg thinks so. Brokers are performing better and the number of customers is increasing, mainly through referrals from existing clients.

“Our people dedicate their time now to more human goals,” Versteeg says. “The salespeople have their pride back and clients are happier than ever before.”

Which brings us back to the integrity of Art DeLorenzo’s commitment. Before he retired in 2005, DeLorenzo was a financial adviser with the retirement planning firm Ameriprise Financial. As group vice president, DeLorenzo was responsible for growing the revenues of the 50-plus advisers who worked under him in Ameriprise’s East Coast market groups. DeLorenzo’s team did a lot of cold-calling and as he says, “They get told ‘no’ a lot. Rejection is a significant part of their lives. If people are not good at managing that baggage, their failure rate is higher.”

Testing salespeople’s emotional competence was a longstanding practise, because, says DeLorenzo, “We knew those who scored the highest in emotional competence were the most successful.”

But he felt they should go further. So in 2000, after the dot-com stock market crash, when his teams were dealing with especially heavy negativity, DeLorenzo took it upon himself to introduce Rick Aberman, a developmental psychologist and founding partner of the Lennick Aberman Group, a consulting firm based in Minneapolis, Minnesota, to Fred Luskin, a psychologist who cofounded the Stanford University Forgiveness Project and authored Forgive for Good. The trio developed a program based on Luskin’s “forgiveness” training.

Why forgiveness? “Interpersonal kindness and goodwill that is almost unlimited—that is the spiritual basis of life,” explains Luskin, who says we develop it by practising what he calls “the three tenets”: compassion, forgiveness and gratitude.

Gratitude is powerful, Luskin says, because it makes it harder to hold onto anger. “It’s a lot harder to feel picked-upon when you’re focused on the experience of being grateful for what you have. When you forgive, your attention is much more placed on the present and the future, rather than locked in needless argument over the past. The less arguing you do, the less angry or depressed you’ll be and the more energy you’ll have to give—to be productive and do a good job.”

In the first pilot program, conducted from September 2001 through August 2002, participants did exercises to help them “identify and hold onto values that enhance productivity,” according to Luskin. For gratitude, he recalls, “we did an exercise where we had people take a drink of water, and do so mindfully and with thanks. You actually tasted the water and focused for a minute on how thankful you were. And you looked at the picture on your desk of your family and you were thankful for that too.” Participants reported feeling more refreshed, and were more productive back at their desks.

They also played a game called “The Freeze.” In the middle of a lecture, DeLorenzo would tell participants to freeze and would write down how they told him they were feeling. “It’s intended to help people realize that even when we’re having a conversation, our minds are not always 100 percent engaged,” he says. It’s during such unconscious moments that our feelings creep up and can negatively affect our behaviour.

If you’re irritated, but aren’t conscious of it, your actions may run contrary to your values—you might get angry with a customer and lose a sale. “If, on the other hand, you stay on top of your feelings, there is a good chance that you’ll keep your feelings in alignment with your values, and your actions will be in alignment with your goals,” says DeLorenzo.

The results were encouraging. Participants showed an average 18 percent increase in commissions on sales compared to 11 percent for those who didn’t go though the seminar. In a sales environment, generating 7 percent more revenue than your colleagues is huge.

To date, 74 advisers have completed the seminar in seven annual programs. Each year, participants have outstripped the average productivity of their peers. The 2002-’03 group showed a 24 percent increase in sales, compared to just 5 percent for non-participants; one of two classes in the 2003-’04 year increased commissions by a stunning 46 percent, compared to 13 percent for those who didn’t receive the training.

Since 2001, participants’ stress scores have dropped 23 percent; anger scores have dropped 13 percent; and “positive-state” scores—whether or not people think positively about the world—have risen 20 percent. Participants’ “physical vitality” scores even improved, by 9 percent. DeLorenzo, Luskin and Aberman now run the program as part of a combined consulting practise, and this year Ameriprise will roll out the training for its Mid-Atlantic Market Group, which includes 1,100 salespeople.

Since 1993, Dr. Hauschka Skin Care (DHSC), based in Waltham, Massachusetts, has been the exclusive U.S. distributor of holistic remedies and skin-care products manufactured by WALA Heilmittel in central Germany. Last year, DHSC sold $20 million worth of creams and cosmetics, made exclusively with organically grown plants and plant extracts. DHSC sources the shea butter for its cosmetics in the tiny western African nation of Burkina Faso, one of the 30 poorest countries in the world. The gross domestic product there per capita is just $1,200.

Susan West Kurz and her husband Clifford owned DHSC until 2006. In that year, they liquidated their equity and put the for-profit operating company into a trust so it would be less likely to be taken over by a large cosmetics firm. The husband and wife team practise spiritual capitalism by helping the residents of Burkina Faso make a sustainable living—and earn a profit for themselves while doing it. “A business has to have a profit to be sustaining,” Susan says. “What you do with the profit is the key.”

What the Kurzes do with their profits is invest them in women’s co-operative farms, which enables the farms to convert to biodynamic agriculture. Susan and Clifford, both of whom are trained in biodynamic farming, believe in the method because, as Clifford explains, “Biodynamics doesn’t exploit the soil. It tries to get the most out of the Earth but in a win-win with nature. Most economies are based on illness and war and profits for a few. This is because most [businesses] have lost their connection to human beings and to the Earth. But you can’t treat the Earth as if it’s a machine. It is a living, growing thing. You can’t take the spiritual part out of it.”

For the residents of Burkina Faso, the spiritual is material. The collectives used to produce less than 100 tons of raw shea butter a year; now, they manufacture more than double that. DHCS buys only about 50 tons annually. Competitors pick up the rest. DHCS could buy up all the biodynamic shea butter in Burkina Faso, negotiating down for a discount, but doesn’t. Why not? Because it makes business sense in the context of the new capitalism. A bigger market for biodynamic cosmetics benefits everyone—the people of Burkina Faso, DHCS and its competitors.

“We want to heal the Earth,” says Susan. “Our method of healing the Earth is not just something lofty. It is very practical and very real. When we bring biodynamics to shea butter farms, that act is transforming the Earth. But it’s also bringing a living, authentic business to the community. [Its members] are better off not being dependent on one company for revenues. For us, this is not just an abstract paradigm. We live our principles.”

Living her principles is also key for Denise Cerreta, an acupuncturist who traded in her needles for cooking utensils and started her own café. The idea of spiritual capitalism hit her like a revelation: “I realized my clients weren’t sick, they were lonely. I had always liked the idea of opening a café, and I realized I could probably serve people better if they could come to something that I had created, rather than just to get ‘a treatment.’”

So Cerreta sold her practise, rented a storefront and opened One World Everybody Eats café, in Salt Lake City, Utah. At Cerreta’s place, there’s no set menu and no set prices. Patrons pay what they think the meal is worth or what they can afford. Those who can’t pay, don’t; instead, they’re asked to wash dishes or serve food.

You might think One World Everybody Eats is a great way to feed the hungry, but doesn’t sound like much of a business. It is though. News of the café spread fast and soon Cerreta had customers lining up at the door.

By 2006, she was producing a 4 percent profit from annual revenues of about $300,000, which compares favourably to more traditional restaurants. In the same year, she converted her business to a non-profit, enabling her to expand faster and help other entrepreneurs open similar cafés in other cities.

Her 12 full- and part-time employees earn at least $10 an hour, more than 70 percent higher than Utah’s current minimum wage. Everyone gets a paid vacation. She doesn’t yet have a health-care plan, but she’s working on it.

Cerreta, 46, doesn’t take home anywhere near the $150,000 a year she made when she was an acupuncturist, but then again, she doesn’t want to. When she told that first customer, “Just pay me what you think the meal is worth,” Cerreta recalls, “it was like my heart expanded and I realized my purpose in life.”

There’s a restaurant based on Cerreta’s model in Denver; another, in Moab, Utah, is expected to open later this year, along with two more, in Durham, North Carolina, and San Francisco, in 2009. “I feel richer now than I did before,” Cerreta says. “I don’t know how to explain it. It’s some sort of phenomena, something like the loaves and fishes.”

It doesn’t take a miracle to believe in the benefits of spiritual capitalism. It just requires a simple cost-benefit analysis. “People mature to where we all give priority to the common good, even if at an immature stage we give priority to ourselves,” the Calvert Group’s Mollner says. Why shouldn’t that be true for companies?

Business and the Buddha author Lloyd Field argues that the traditional profit-for-profit’s-sake model of doing business isn’t just flawed but “based on greed, hatred and delusion.” Writes Field, “I do not believe this is what Adam Smith intended. The societal ills that result from this … stand in stark contrast to [Smith’s] goals.”

Instead, Field suggests a whole new kind of financial metrics, “so that the value of a company becomes not a single number based on its profits, but a composite number that includes its spiritual health.” Sound too good to be true? Take a look around. It’s already happening, at companies like Allianz, Ameriprise, Dr. Hauschka, One World Everybody Eats and countless others.

The spirit of capitalism moves in mysterious ways.

Carleen Hawn is a business journalist based in San Francisco. Max Christern is the editor of the Dutch edition of Ode.

June, 2008 issue | http://www.odemagazine.com/doc/54/the-gospel-according-to-adam-smith

|